October 2025 BNG Pricing Report: More Data, More Clarity

Knowing what you can expect to pay for off-site Biodiversity Net Gain units - and whether they're easily available - lets you better plan budgets and invest wisely in your next development.

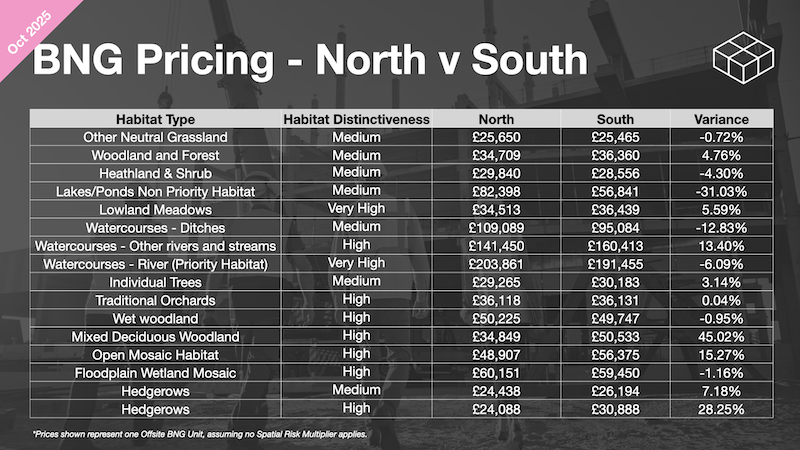

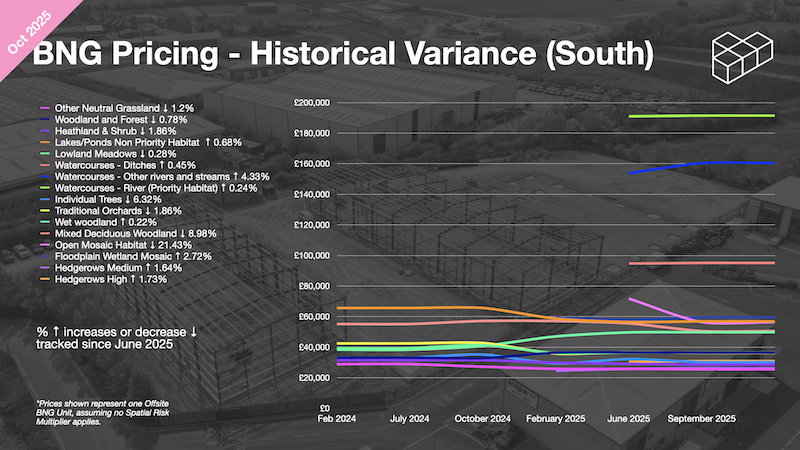

Our October 2025 BNG Pricing Report contains anonymous data from 95 habitat banks across England, combining sites already on the Natural England Register with those expected to register within six months.

This is our biggest dataset in our 6 reports to date - up from 77 in June.

Through our new partnership with Natural Asset Partners and their BNG Data Insights platform, this edition adds a new section examining live data from the Natural England Register - all brought to life visually.

More data, more clarity, all building on our mission to give you BNG certainty.

This blog is a summary of the key points.

Access the full October 2025 BNG Pricing & Insights Report here

Habitat Banks Are Following Developer Demand

The most encouraging trend we see in our report: habitat banks are setting up where developers actually need them.

In June, we saw a range of geographic imbalances across England - with more urban locations being particularly underserved. That's changing and operators are establishing sites strategically, near areas with strong development pipelines.

What this means:

Improving options in previously underserved areas

Less need to source from distant suppliers

Lower risk of incurring Spatial Risk Multipliers costs

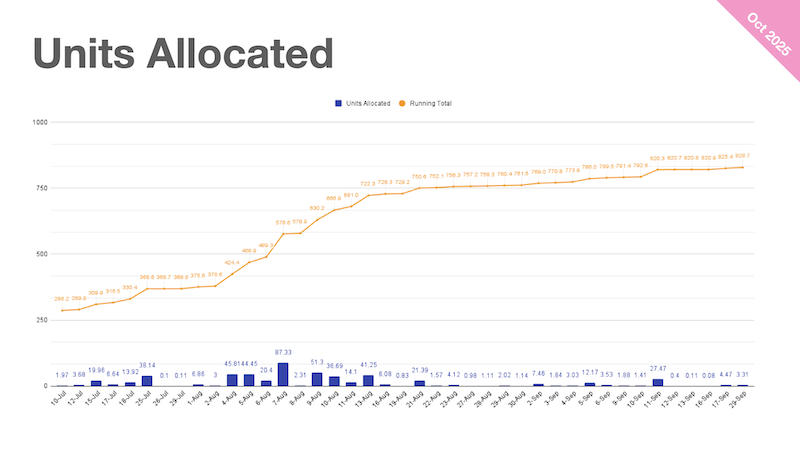

Data from the Natural England Register

This edition marks the first time we're sharing allocation data directly from the Natural England Register - all thanks to Natural Asset Partners.

This is a step forward in market transparency - the data shows:

125 registered habitat banks (up from 90 in June)

828.7 units allocated so far

Other Neutral Grassland registered most frequently: 1,774 units across habitat banks

Other Neutral Grassland also most allocated: 93 separate allocations to developments

Top locations by allocation: South Cambridgeshire (80 units), Sheffield (64 units), Westmorland and Furness (59 units)

Important caveat: This register data remains a lagging indicator of true market activity. Allocations typically occur at the end of a development process when BNG conditions are discharged. This data should be seen as one part of a broader picture, showing where activity has been rather than where supply constraints might emerge next.

Out-of-Area Discounting Continues

Habitat Banks in lower-demand regions are continuing to offer strategic discounts on out-of-area units to compete with suppliers in high-demand areas.

It remains to be seen if this more aggressive pricing strategy can be sustained.

This could be an opportunity for your BNG supply options, but requires careful planning to ensure units meet your specific requirements - as it could face pushback from your LPA.

More broadly, we see that developers are now able to source units in-area or in adjoining NCAs across almost all parts of England - with the exception of rare habitat types like watercourses.

Plan Early, Plan Smart

The overall BNG market is continuing to mature with improved supply and strategically created growth.

But not all habitat types are equally available, and no two projects are the same. It’s always best to plan early to ensure you can secure the right units you need at the best price.

Ian Hambleton, Founder & Director of Biodiversity Units UK, commented: "The data is clear - this is a growing and increasingly sophisticated market. Supply is responding to demand, pricing remains stable and availability of rare habitat types is improving. We really are gaining momentum towards a nature-positive future."

Big Thank You

This report is only possible because of that openness and collaboration of all our partners, suppliers, and clients who continue to share their data, insights, and on-the-ground experience with us.

On behalf of the whole team at Biodiversity Units UK, thank you for continuing to be part of this journey.

We'll continue to publish quarterly updates to provide developers and suppliers with a clear view of the evolving BNG market.

Access the full October 2025 BNG Pricing & Insights Report here